Financial Literacy

Loan and Financial Education Program

Serving Lower Fairfield County

Are you struggling to pay your bills each month? Feeling overwhelmed by your finances and have no idea where to start? Catholic Charities Loan and Financial Education program has been serving the community for over 20 years. We serve all people without regard to age, race, or religion. We are dedicated to providing free financial education and budgeting services to those who are socioeconomically disadvantaged. Our caring and experienced counselors will work with you one-on-one to develop a personalized budget, offer tips on how to save money, and provide resources for achieving your financial goals. Investing in your financial well-being has never been more important. Don’t let fear or financial stress hold you back any longer.

Loans are available to qualified applicants for cars, Immigration fees, childcare costs, home repairs, job training, school tuition, and other unplanned expenses. Loans are issued to a third party and cannot be used for past due bills or outstanding debt. (Loans take an average of 4 to 6 weeks for approval.)

Services

• Personalized budgeting advice

• Helpful financial education and resource materials

• One-on-one client support during the loan process

• Access to loans up to $10,000 at a fixed 5.5% interest rate regardless of credit score or credit history.

• Flexible loan repayment schedule

• Open to non U.S. residents with foreign passport and proper documentation

• Referral to other community resources

• Peace of mind provided by Catholic Charities, one of the largest and oldest social service providers in Connecticut

Frequently Asked Questions

All residents of Fairfield County over the age of 18 may apply for financial education and loans.

Catholic Charities has two loan programs serving Fairfield County:

- Loan and Financial Education Program (Lower Fairfield County): Bridgeport, Darien, Easton, Fairfield, Milford, New Canaan, Norwalk, Shelton, Stamford, Stratford, Trumbull, Westport, Weston, Wilton

- Family Loan Program (Greater Danbury area): Ridgefield, Redding, Bethel, Newtown, New Fairfield, Brookfield, Monroe, New Milford. Individuals outside the Danbury area may still be considered if they work in the designated area.

Loan and Financial Education Program: No, applicants must provide an ITIN, a foreign passport, and two additional forms of identification if they do not have a Social Security number.

Family Loan Program: Yes, a Social Security number and valid driver’s license are required.

Yes. Credit history is reviewed but does not affect loan approval. Credit reports are used as educational tools and to process loan documents. Timely loan payments can help improve a client’s credit over time.

Loans are available for cars, immigration fees, childcare, home repairs, job training, school tuition, and other unplanned expenses. Loans cannot be used for past due bills, credit card debt, or living expenses such as rent, food, or utilities. Please check with the loan program manager for specific eligibility.

Borrowers may be eligible for loans up to $10,000. Limits vary by program and purpose:

- Car purchases: up to $10,000

- Vehicle repairs or security deposits: up to $2,000

- Childcare-related costs: up to $1,000

- Other purposes: contact loan program manager

Loan approval generally takes 4–6 weeks, depending on client availability for budget counseling and submission of necessary documents.

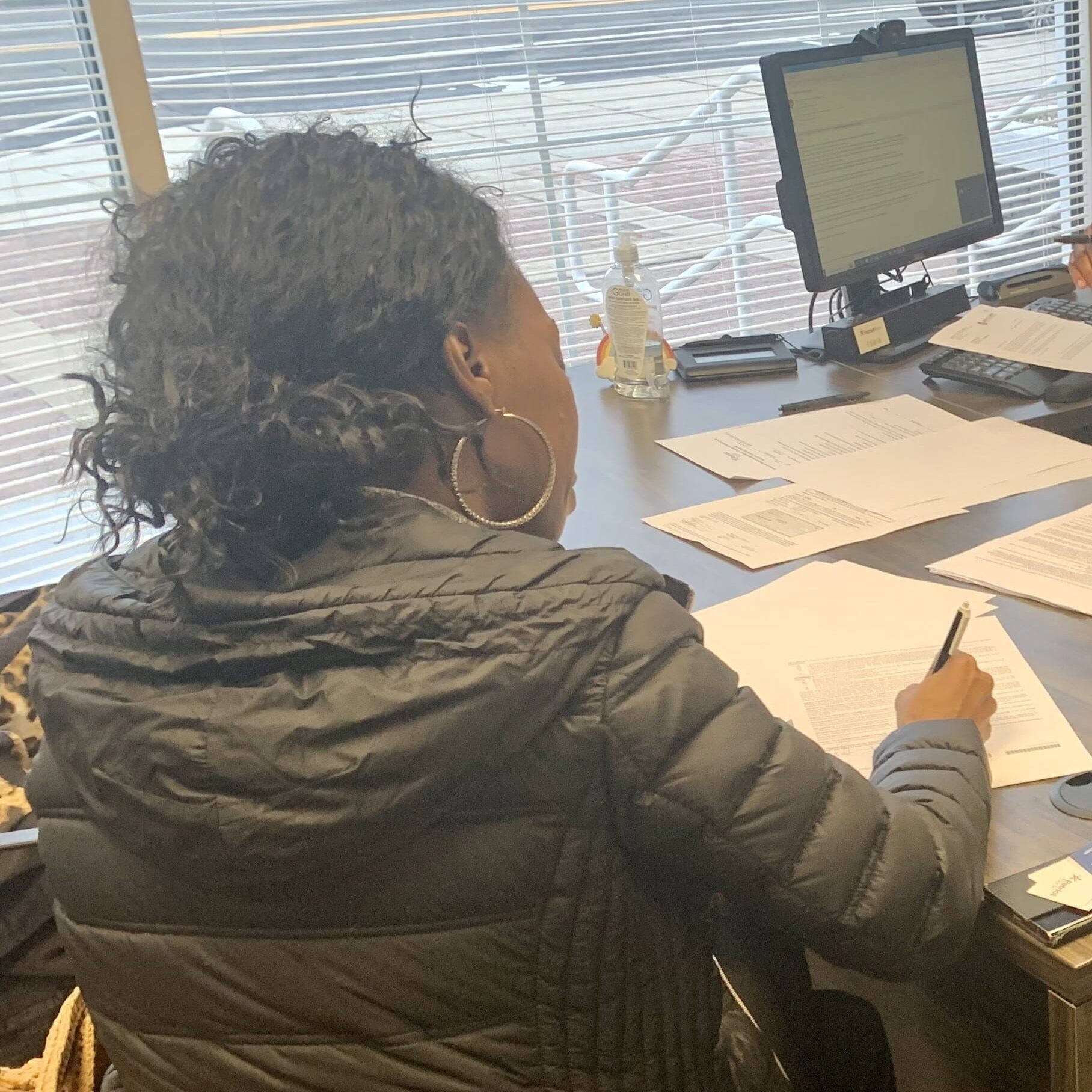

Applicants receive free, one-on-one financial education and budget counseling, designed to support successful repayment and strengthen financial self-sufficiency. Services include personalized budgeting advice and access to helpful resources. Available in-person, online, or by phone.

No. The interest rate is fixed at 5.5% regardless of credit history.

No. There is no penalty for early repayment.

Who to Contact

Diane Barston, Manager

203-767-4854

[email protected]

Location

120 East Avenue 2nd Floor

Norwalk, CT 06851

(Located across the street from Norwalk City Hall)

Program Hours

Please call or email for an appointment: Virtual appointments also available.

Monday-Friday

9:00 AM – 5:00 PM (please call or email for an appointment)

In addition to our Norwalk location, we also offer Family Loan Program services in Danbury. Learn more about our Danbury location here.

Testimonials

“At this time in my life it seems that a rain storm started and kept going. One day I decided to reach out for help, which is a hard thing to do, and where do you start? I was referred to Catholic Charities and then I met Diane Barston — another blessing! As soon as I spoke with her, I felt safe and in good hands. This loan helped me get on my feet to meet more than one goal: financial stability, safety for my family, and an overall better quality of life.”

Charlotte

Loan and Financial Education Program Client

“The family and I just wanted to thank you again for the effort and time towards keeping our house warm!”

Loan and Financial Education Program Client

“My husband and I received our permanent resident cards today! This is such a special moment for us, and we couldn’t have reached it without you. We are deeply grateful for your support — you truly made a difference in our lives. You will always hold a special place in our hearts for helping make this dream a reality.”

Loan and Financial Education Program Client

The Latest Financial News

Required Documents

Loan and Financial Education Program in the news:

How the Family Loan Program of Danbury Helped a Single Mother Regain Stability

Learn how Catholic Charities’ Family Loan Program of Danbury helped a single mother overcome transportation challenges and build long-term financial stability through affordable loans and one-on-one budgeting support.

Learn about the Loan and Financial Education Program in this video from New Covenant Center!

Program funds generously provided by:

This program was made possible [in part] by Fairfield County’s Community Foundation and United Way of Coastal and Western Connecticut.

Stay Connected

Join our community of volunteers, donors, and friends who are making a difference across Fairfield County.

Sign up below to receive updates on ways to get involved and help your neighbors in need.