Family Support

Loan and Financial Education Program

Lower Fairfield County

Loans are available to qualified applicants for cars, Immigration fees, childcare costs, home repairs, job training, school tuition, and other unplanned expenses. Loans are issued to a third party and cannot be used for past due bills or outstanding debt. (Low interest loans take an average of 6 to 8 weeks for approval.)

Services

• Personalized budgeting advice

• Helpful financial education and resource materials

• Support throughout the life of the loan

• Access to loans up to $10,000 at a low 5.5% interest rate regardless of a bad credit score of no credit history. The interest rate on the loan never changes.

• Flexible loan repayment schedule

• Referral to other community resources

• Peace of mind provided by Catholic Charities, one of the largest and oldest social service providers in Connecticut

Who to Contact

Diane Barston, Manager

203-767-4854

[email protected]

Location

120 East Avenue 2nd Floor

Norwalk, CT 06851

(Located across the street from Norwalk City Hall)

Program Hours

Monday-Friday

9:00 AM – 5:00 PM

Testimonials

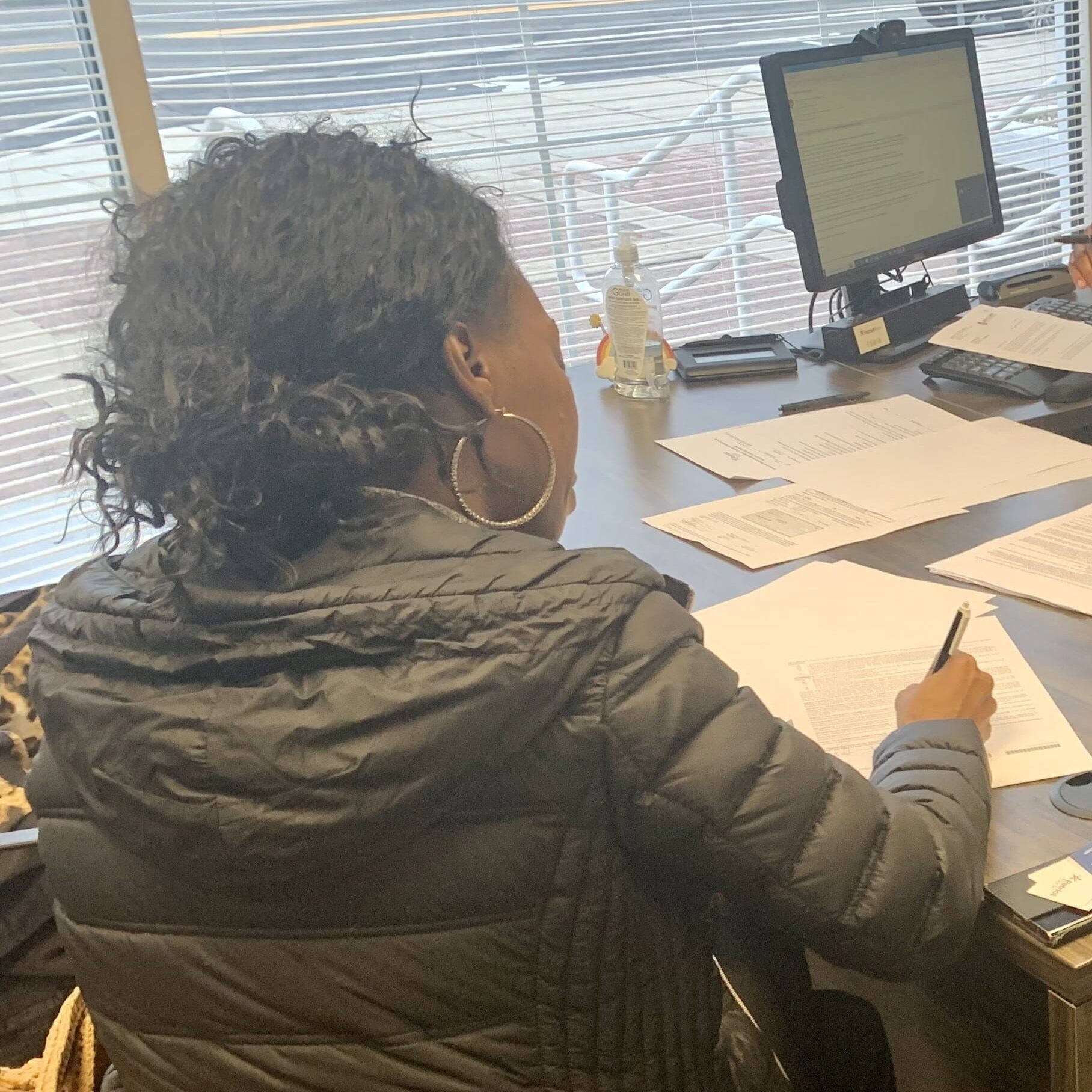

At this time in my life it seems that a rain storm started and kept going. One day I decided to reach out for help which is a hard thing to do, and where do you start? I was referred to Catholic Charities and then I met Diane Barston. Another blessing!! As soon as I spoke with her, I felt safe and I was in good hands. This loan helped me to be able to get on my feet to meet more than one goal. Financial stability, safety for my family and overall better quality of life.

The Latest Financial News

Important Documents and Information

YOU CAN BUILD CREDIT WITHOUT A CREDIT CARD

You don’t need to juggle credit cards to earn a killer credit score. Learn more…

https://money.usnews.com/credit-cards/articles/how-to-build-credit-without-a-credit-card

Loan and Financial Education in the news:

Navigating Inflation: How Catholic Charities Helps Those in Need

During periods of inflation, every dollar buys less than it did before, eroding purchasing power, affecting savings, and impacting overall financial well-being. “Financial literacy is always an important tool for our clients. However, in hard economic times when inflation is high, the importance of financial literacy cannot be overstated,” states Donoghue. “It is one of the reasons why Catholic Charities offers two financial literacy programs, one in Danbury and one in Norwalk. We have seen how crucial financial literacy is for the long-term success of our clients.”

Gain New Financial Confidence with the Loan and Financial Education Program of Catholic Charities!

Are you struggling to gain financial stability? Do you need assistance in managing your expenses and budgeting? Look no further than the Loan and Financial Education Program at Catholic Charities! Our dedicated team is here to help you every step of the way.

Learn about the Loan and Financial Education Program in this video from New Covenant Center!

Program funds generously provided by:

This program was made possible [in part] by Fairfield County’s Community Foundation.

This program was made possible [in part] by United Way of Coastal and Western Connecticut.